Some highlights from the recent update by Herve Hoppenot at the JP Morgan Healthcare Conference:

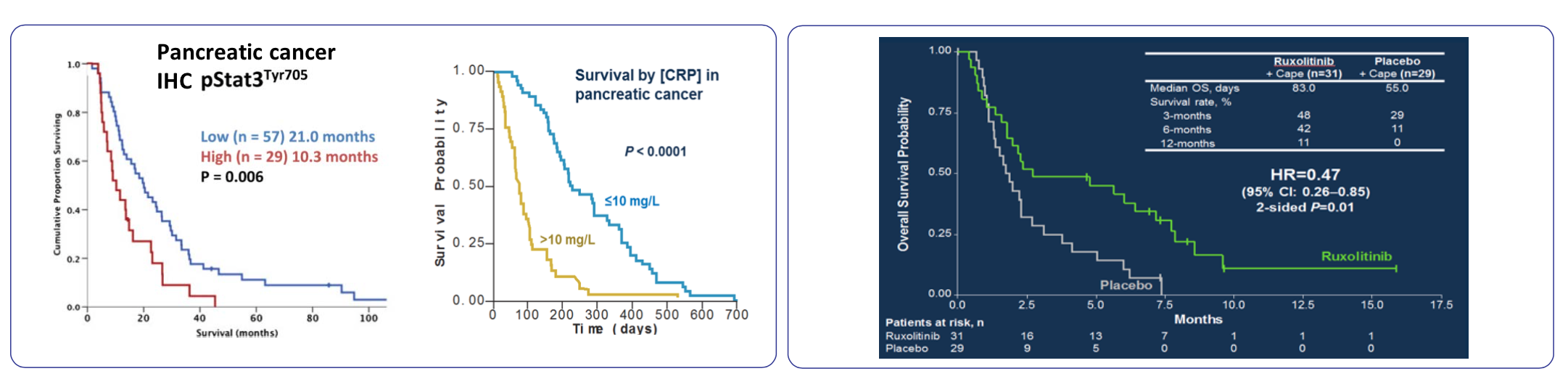

- The company anticipates results from the Janus 1 and 2 trials to be available in 2016. As a recap, these trials are focusing on the use of ruxolitinib with capecitabine in patients at different stages of pancreatic cancer. These trails are pursuing a prespecified patient population based on the exploratory phase 2 data suggesting a relationship between CRP and ruxolitinib treatment. Whether that relationship is causal or correlative yet unrelated remains to be seen. Typically, markers such as CRP are reliably indicative of disease but have not been great prognostic companions for treatment subgroups.

- The controlled phase 2 trials of combination ruxolitinib therapy in colorectal, nonsmall cell lung and breast cancers continue. Data are expected in 2016.

- In an attempt to protect / expand their lead in the JAK space, the company is pursuing development of its selective JAK1 inhibitors, INCB39110 and 52793. The latter is the newer addition to the clinic and, compared to 39110, has ~5x the increased selectivity for JAK1 vs JAK2. The rationale behind this is to minimize the JAK2 inhibition of a mixed JAK1/2 inhibitor like ruxolitinib, thereby attempting to minimize myelosuppression. INCB39110 is already in the clinic in combination studies for nonsmall cell lung and pancreatic cancers. The more interesting INCB39110 trial is in B-cell malignancies where it is being tested in combination with Incyte’s internal PI3Kd inhibitor INCB40093. The newer molecule, INCB52793, is just entering dose finding phase I studies.

- Addressing the recent Agenus deal, the message was as I suspected: this is mostly a tools deal. Incyte believe that their internal engine is strong on the small molecule front, but they see a relative weakness in biologics. The Agenus platform will allow them to screen for fully humanized antibodies against targets of their choosing. Not too surprising, since biologics are a very relevant and meaningful platform and Incyte had not yet shown much acumen in this regard.

- On the PI3Kd front, Incyte has two candidates: INCB40093 and a more recent compound, INCB50465. The latter compound is roughly an order of magnitude more potent in preclinical assays. However, the benefit of this increased potency is unclear. Interestingly, although their slide deck showed preclinical data rationalizing the combination of INCB40093 and INCB39110, no such data were shown for INCB50465. Therefore, it remains uncertain if the increased potency has a material benefit in either combination or monotherapy use.

- Two new molecules, INCB54828 and 54329 are FGFR and bromodomain inhibitors (see this link for a general background), respectively. For INCB54828, no data were broken down for its relative selectivity among FGFR1, 2 or 3. For the bromodomain inhibitor, the requisite mouse model data were shown… but as usual, such data are necessary for advancement but not overly useful in predicting clinical efficacy. These compounds do appear to be moving ahead, however, as the bromodomain inhibitor was noted as entering the clinic imminently.

- A wild card for Incyte this year will be the rheumatoid arthritis program. The first phase 3 readout occurred late last year and was positive. Readouts for the remaining 3 trials are expected this year, and of particular interest to me is the RA-BEAM trial that will include structural endpoints and include Humira as a comparator. The biologic market for RA is very large, but to date the small molecule competitor, Xeljanz (tofacitinib), has not made much of a dent. I think Incyte’s baricitinib has advantages over Pfizer’s tofacitinib, with the latter being a JAK3 inhibitor and the former a mixed JAK1/2. Cross-talk between JAK1 and 3 is possible, and I think a slight safety advantage may emerge for baricitinib versus tofacitinib. Whether this combination of efficacy and safety makes a dent on biologics remains to be seen. My suspicion is that it does not in the near term (1-5 years), but for a company the size of Incyte, obtaining revenue from the RA market would be significant.